people's pension higher rate tax relief

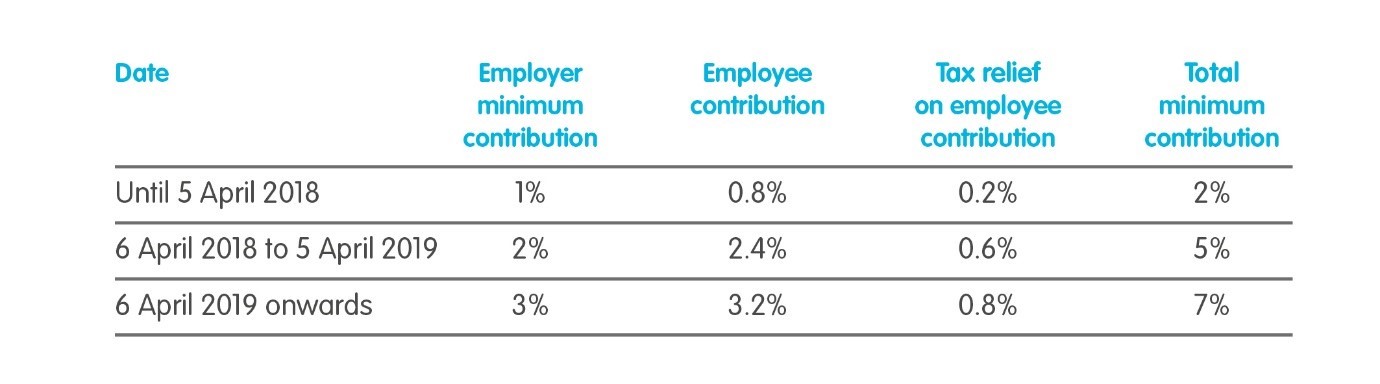

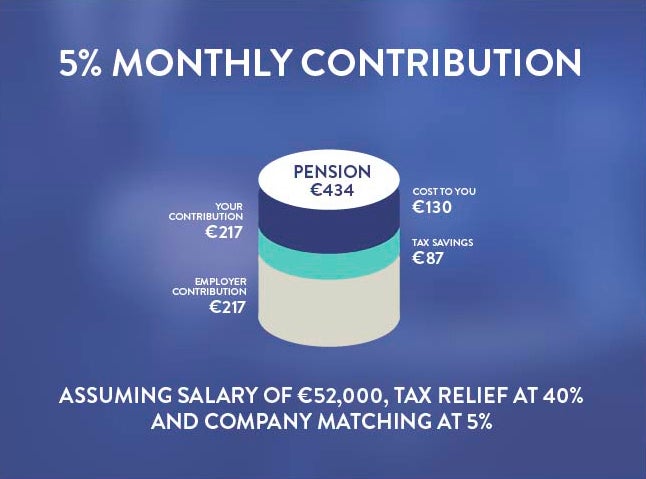

Your employer has to contribute if youre in a workplace pension and earn over 6240 a year. Additional-rate taxpayers can claim 45 pension tax relief.

Q A Pension Automatic Enrolment International Reward

Pension Higher Rate Tax Relief.

. Higher-rate taxpayers who pay 40 per cent tax can currently claim back an additional 20 per cent via their self-assessment while top-rate taxpayers can claim an additional 25 per cent. Pension Higher Rate Tax Relief. Understanding how higher and additional-rate tax relief is claimed can seem quite complex.

Tax relief is paid on your pension contributions at the highest rate of income tax you pay. Therefore all your pension contributions are effectively increased by 25 per cent sic automatically because every 80 turns into 100. Your employer deducts your contributions from your pay before they calculate the tax due from your pay.

The threshold for higher rate tax is 50270. This means that you receive tax relief at the highest rate of tax that you pay. The trade body suggested reducing the amount of pension contribution eligible for tax relief from 255000 to about 50000 which will limit the tax relief available to high earners but in a way less harmful to pension provision.

The additional amount of tax relief you can claim is normally 20 of your contributions taking the. Basic-rate taxpayers get 20 pension tax relief. Higher-rate taxpayers can claim 40 pension tax relief.

If youre an additional-rate taxpayer total income in excess of 150000 for current tax year 201920 you will only be able to claim the further 25 tax relief for your personal pension payments by submitting a self-assessment tax return. Tax relief helps your pension grow. Your scheme members who are Scottish taxpayers liable to Income Tax at the Scottish intermediate rate of 21 can claim the additional 1 relief due on some or all of their contributions above the.

At that rate a 22-year-old earning 27000 paying 4pc in pension contributions would be 21000 better. But for higher and additional rate taxpayers this means they can shift some of their income out of 40 or 45 tax bracket and instead pay just 20 thereby receiving higher rate relief. Shadow chancellor Ed Balls has announced that Labour is set to restrict tax relief on pensions for those earning over 150000 a year in order to reduce current unemployment levels.

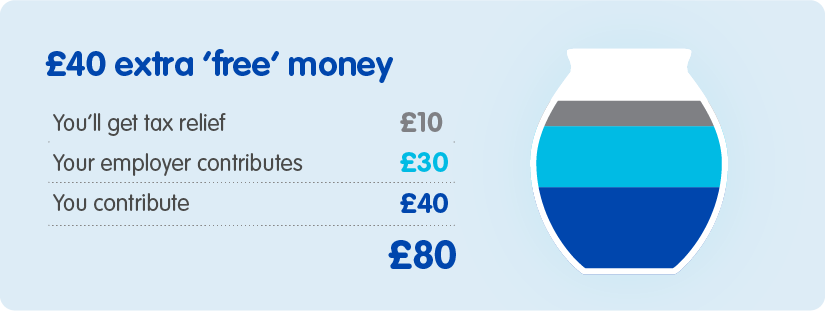

Auto-enrolment in the expanding National Pension Scheme NPS will help as would raising the threshold for higher-rate tax. For every 80p you contribute to your Nest pension well claim 20p from the government on your behalf and add this extra money to your pension pot - if youre eligible. 445 50 votes.

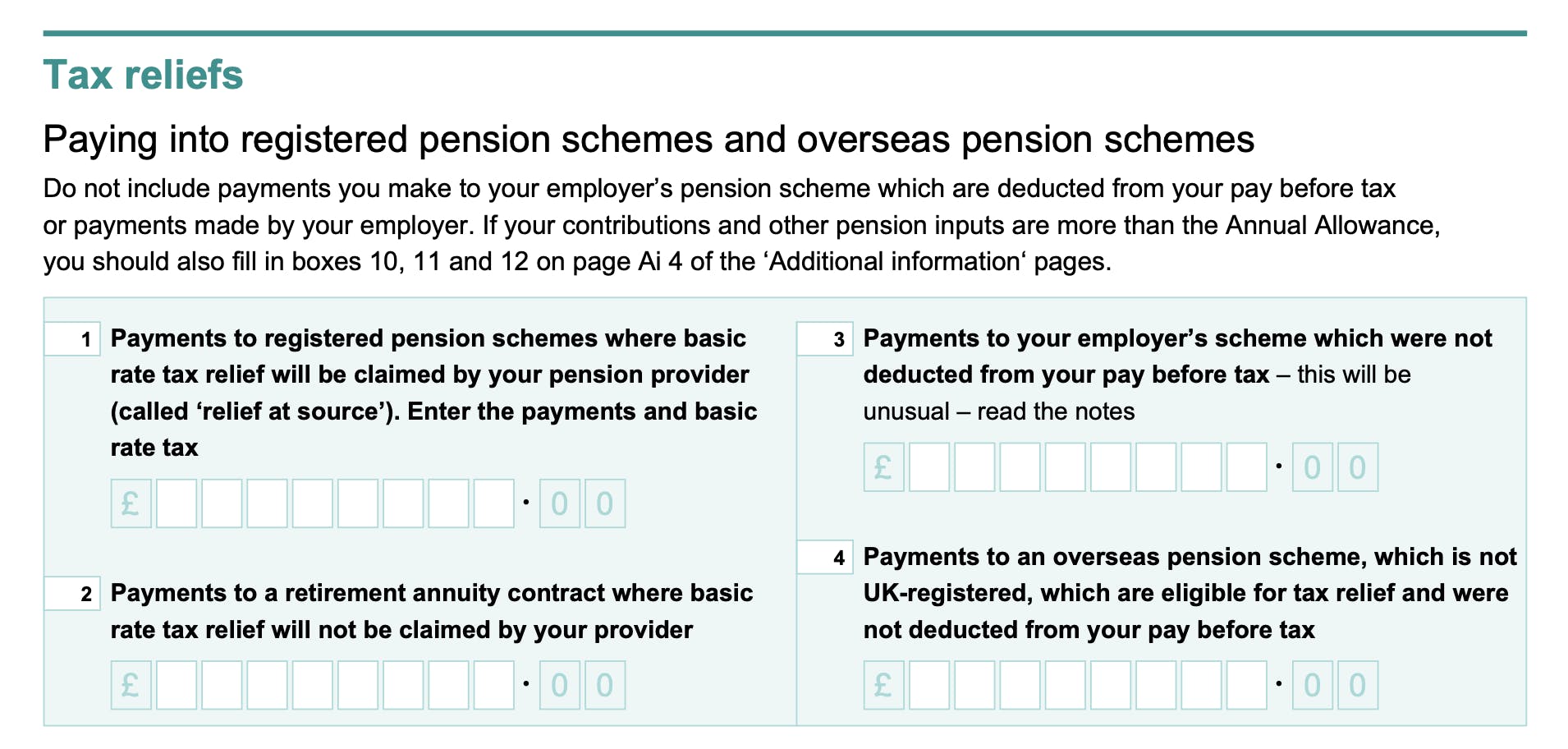

Pension tax relief How does it work. If an employee does not earn enough to pay Income Tax they can still receive tax relief on pension contributions. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of.

When you earn more than 50000 per year you can claim an additional tax relief either an extra 20 for higher rate taxpayers or 25 for additional rate taxpayers to be added to your pension pot. You will automatically get tax relief at 20 on your pension but if you pay higher rate income tax its up to you to claim the rest. Hi Im struggling to get my head round the tax relief on a company salary sacrifice pension when my salary is close to the higher rate tax band.

Relief at Source is usually considered fairer for lower paid workers. The tax relief is currently available on contributions up to a maximum of 3600 per year or 100 of earnings whichever is greater. 20 up to the amount of any income you.

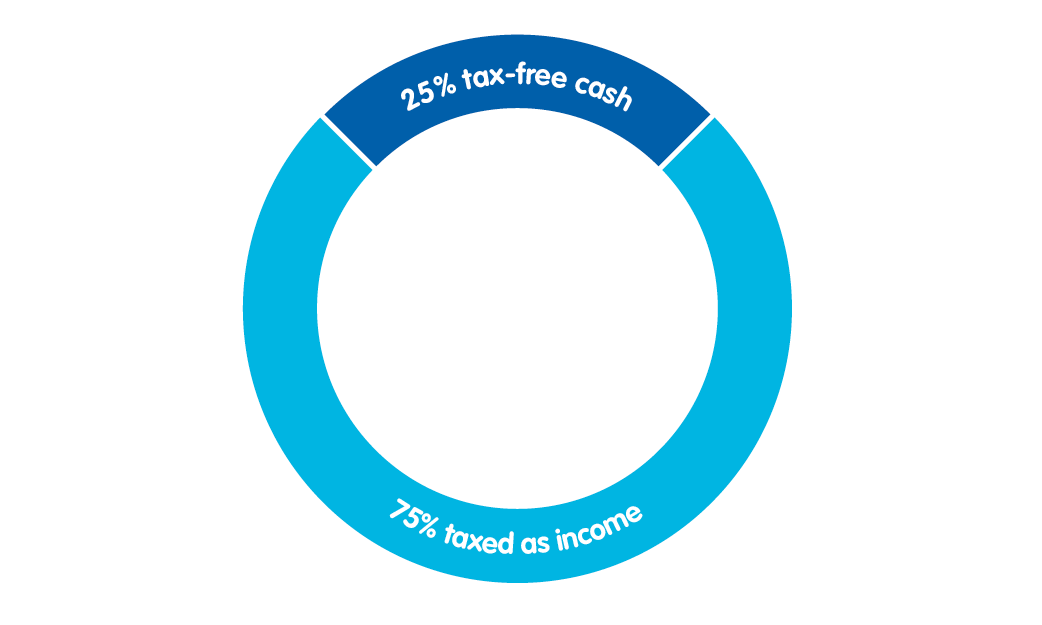

You can put up to 40000 a year into your private pension and up to 107 million over your lifetime. Your workplace pension includes. This is called a net pay arrangement.

One of the best things about saving into a workplace pension is tax relief. You should do this by filing a tax return. In 2019 the threshold was.

Most people also get a contribution from the government in the form of tax relief. Around 300000 Britons could be affected by this new proposition as it would mean that the wealthy would get a 20 per cent tax relief on savings compared to. The value of the tax relief to standard-rate taxpayers has come down.

This means some of your money that would have gone to the government as income tax goes into your pension instead. If you pay tax at 20 no further relief is due to you. There are three different ways that you may receive tax relief on your contributions.

Anyone earning above that level pays 40 tax on a portion of their earnings. This will be less damaging to pension saving and cost far less to implement Segars said. Under a Net Pay Arrangement.

This means that for every 80p of pension contributions you make your basic rate band is extended by 1.

Employee Tax Relief Brightpay Documentation

Q A Pension Automatic Enrolment International Reward

Pension Tax Tax Relief Lifetime Allowance The People S Pension

60 Tax Relief On Pension Contributions Royal London For Advisers

What Are The Minimum Contribution Levels When Pensionable Or Total Earnings Basis Is Used Help And Support

Sipp Tax Relief I How Sipp Tax Relief Works Interactive Investor

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Workplace Pension Contributions The People S Pension

How To Add Pension Contributions To Your Self Assessment Tax Return

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

Pension Contributions And Tax Relief For Limited Company Directors

How Do Pensions Work Moneybox Save And Invest

Your Handy Guide To Company Pensions